ev tax credit bill number

The credit ranges from 2500 to 7500 depending on the size of your vehicles battery. The maximum amount of the federal electric vehicle tax credit is 7500 based on a specific formula and subject to phase out as explained below.

Are Ev Tax Credits Back On The Table Maybe E E News

What Is the EV Tax Credit.

. Based on our recent estimates and forecast Toyota will be the next manufacturer to reach the 200000 tax credit phaseout threshold. After a company sells 200000 eligible plug-in electric vehicles the credit begins to phase out in the. Hopefully that number exceeds 7500 for the tax year.

The credit amount will vary based on the capacity of the battery used to power the. In 2020 the number of EV or electric vehicles decreased to 322000 from 2019. State and municipal tax breaks may also be available.

The electric vehicle tax credit hasnt changed for the past three years. The EV tax credit has traditionally only applied to new cars but this bill provides up to 2500 credit for used EVs with at least a 10 kWh battery although the credit cannot exceed 30 of the sale price. The bill was first introduced in the US House of Representatives in February and proposed creating a 30 tax credit to incentivize the purchase of new electric bicycles in the US.

Congress considers EV tax credit revamp to help Tesla GM and used EVs. There is a federal tax credit of up to 7500 available for most electric cars in 2022. If an EV buyer has a tax bill of say 3000 at the end of the year the EV tax credit can only be a maximum of 3000.

For vehicles acquired after December 31 2009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity 417. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. The Build Back Better bill includes a 12500 EV tax credit up from the current 7500 available to qualifying cars and buyers.

Briefly lets look at a. Claiming state rebates and credits on top. The number that we see most often the 7500 tax credit is available for fully electrified vehicles those that run on battery power alone.

The House version also has a. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles. Federal Tax Credit Up To 7500.

As of September 2018 there were seven states offering 2000 or more in EV incentives on top of the 7500 from the feds. If you purchased a new vehicle that runs on electricity drawn from a plug-in rechargeable battery you may be eligible to claim the qualified plug-in electric drive motor vehicle tax credit which can reduce your tax bill. So for example the Kia Niro EV is eligible for the full 7500 tax credit.

Electric vehicle tax credit limits 2021. The exceptions are Tesla and General Motors whose tax credits have been phased out. As part of a massive 35 trillion reconciliation spending bill the credit faces an uncertain future.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. An expansion of the EV tax credit. The credit ranges between 2500 and 7500 depending on the capacity of the battery.

Marie Sapirie of EEs Tax Notes group reports on some potential big. As it depends on the number of units an automaker has sold. EVAdoption will update our Federal EV tax credit phase-out tracker a few times per year so check back on a regular basis.

Your tax bill will be reduced to 0. Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. The Kia Niro PHEV.

A tax credit means an EV buyer will receive up to a 7500 reduction in their tax liability for the year. President Bidens Build Back Better bill would increase the electric car tax credit from 7500 to 12500 for qualifying vehicles however this bill has only passed and not the Senate as of April 2022. However the 2020 electric car market.

But this is a flat credit which means it is only worth the full 7500 if the individuals tax bill is at least 7500. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. Use this chart to find your credit amount.

The first five kilowatt hours of battery capacity earns you another 417 credit. A federal tax credit is available for 30 of the cost of the charger and installation up to a 1000 credit means 3000 spent. January 13 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car.

And the buyers adjusted gross income AGI has a cap at 75000 for individuals 112500 for head of household and 150000 for joint. In order to take the credit you must file IRS Form 8936 with your return and meet certain requirements. We are currently updating sales estimates through December 31 2021 for the automakers.

As a rough rule of. The 175 trillion Build Back Better Act narrowly approved on a party-line vote in the House early Friday sees the federal incentive for EV purchase soar to. In Connecticut 3000 and Delaware.

The current 7500 EV tax credit which allows taxpayers to deduct part of the cost of buying an electric car phases out once an automaker hits 200000 cumulative EV sales and both Tesla TSLA. The US Senate Finance Committee has put forth a bill to extend and strongly improve the US federal EV tax credit. The tax credit for PHEVs depends on the size of their battery with the lowest credit being 2500.

How much is the electric vehicle tax credit worth in 2021. If you purchased a Nissan Leaf and your tax bill was 5000 that. The formula includes a base credit of 2500 plus an amount calculated based on battery capacity.

The amount of the credit will vary depending on the capacity of the battery used to power the car. The tax credit is also. If you have state EV tax credits available youll hope the number is higher.

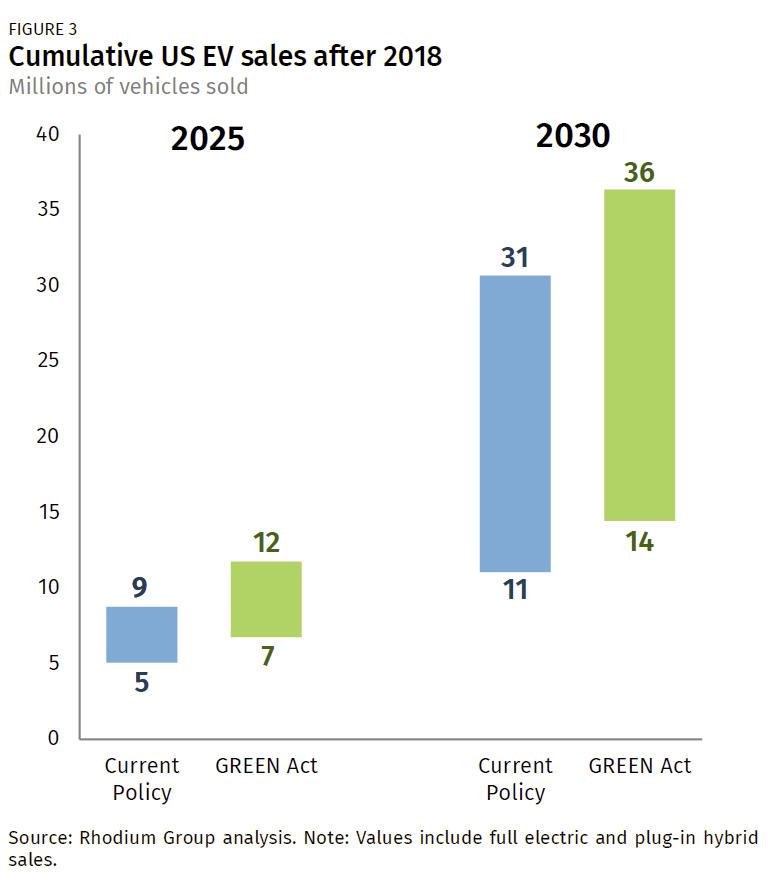

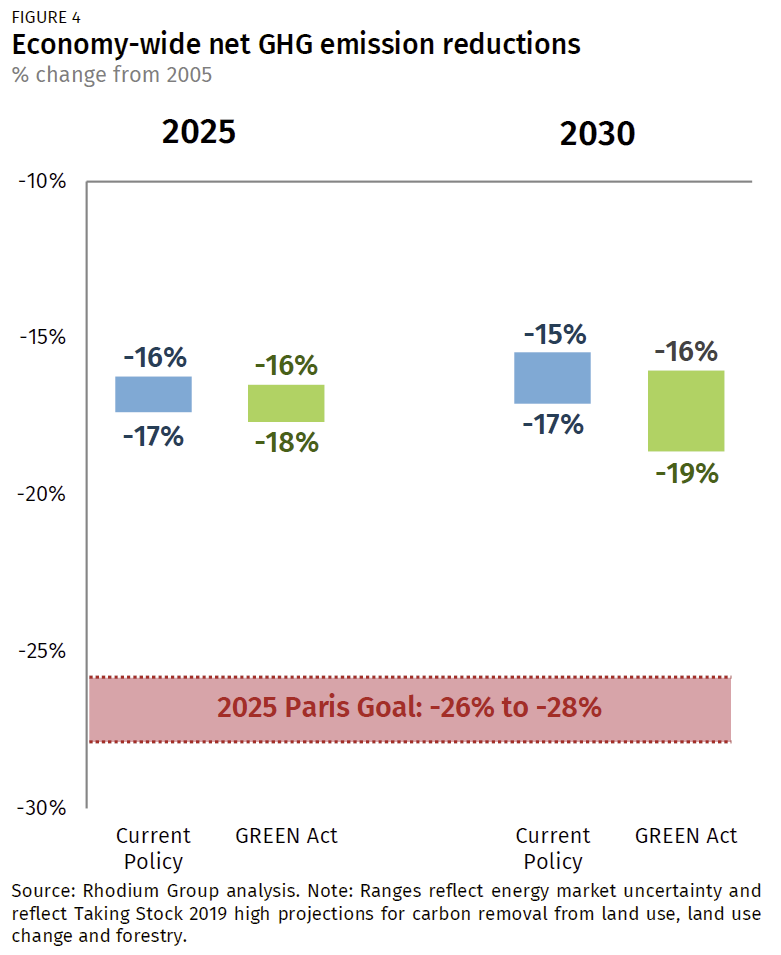

An Assessment Of The Green Act Implications For Emissions And Clean Energy Deployment Rhodium Group

Tesla Toyota And Honda Criticize 4 500 Tax Credit For Union Made Evs

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

An Assessment Of The Green Act Implications For Emissions And Clean Energy Deployment Rhodium Group

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Electrify Your Ride Program 3ce

Electric Vehicle Tax Credits Rebates Snohomish County Pud

Proposed Changes To Federal Ev Tax Credit Part 5 Making The Credit Refundable Evadoption

Joe Manchin Is Blocking The Electric Vehicle Tax Credit Protocol

How Electric Vehicle Tax Credits Work

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Proposed Changes To Federal Ev Tax Credit Part 5 Making The Credit Refundable Evadoption

Tesla Gm Lose Bid To Raise Ceiling For Federal Ev Tax Credit

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Latest On Tesla Ev Tax Credit March 2022

U S Senate Panel Wants To Raise Ev Tax Credit As High As 12 500

Latest On Tesla Ev Tax Credit March 2022

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals